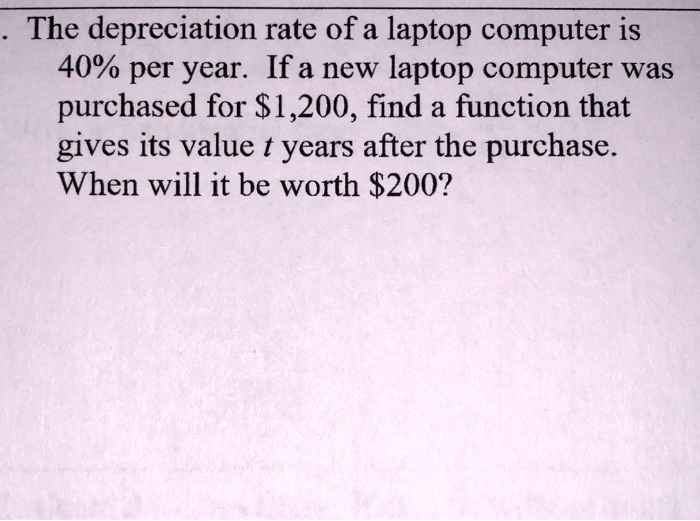

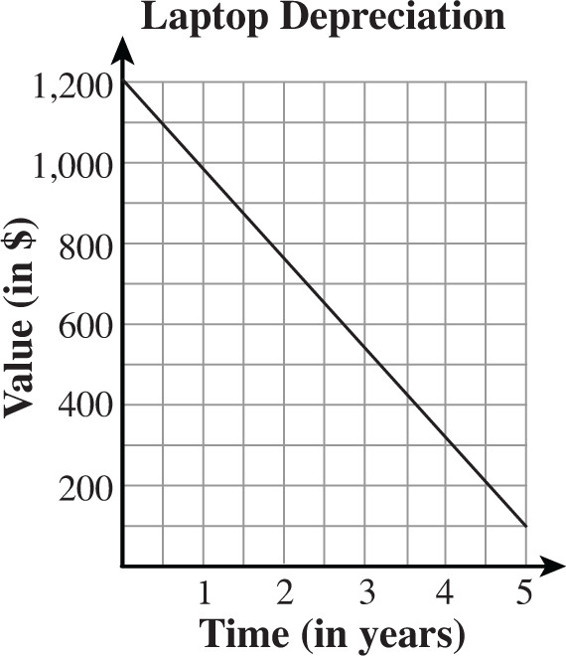

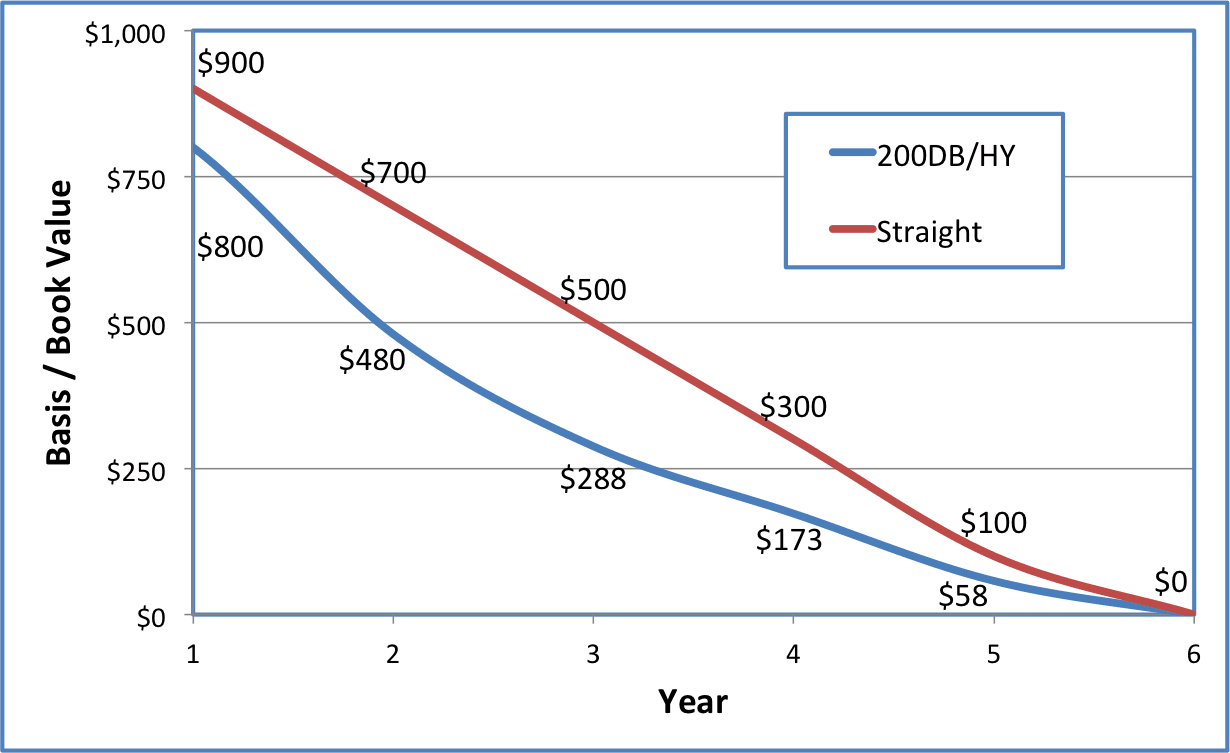

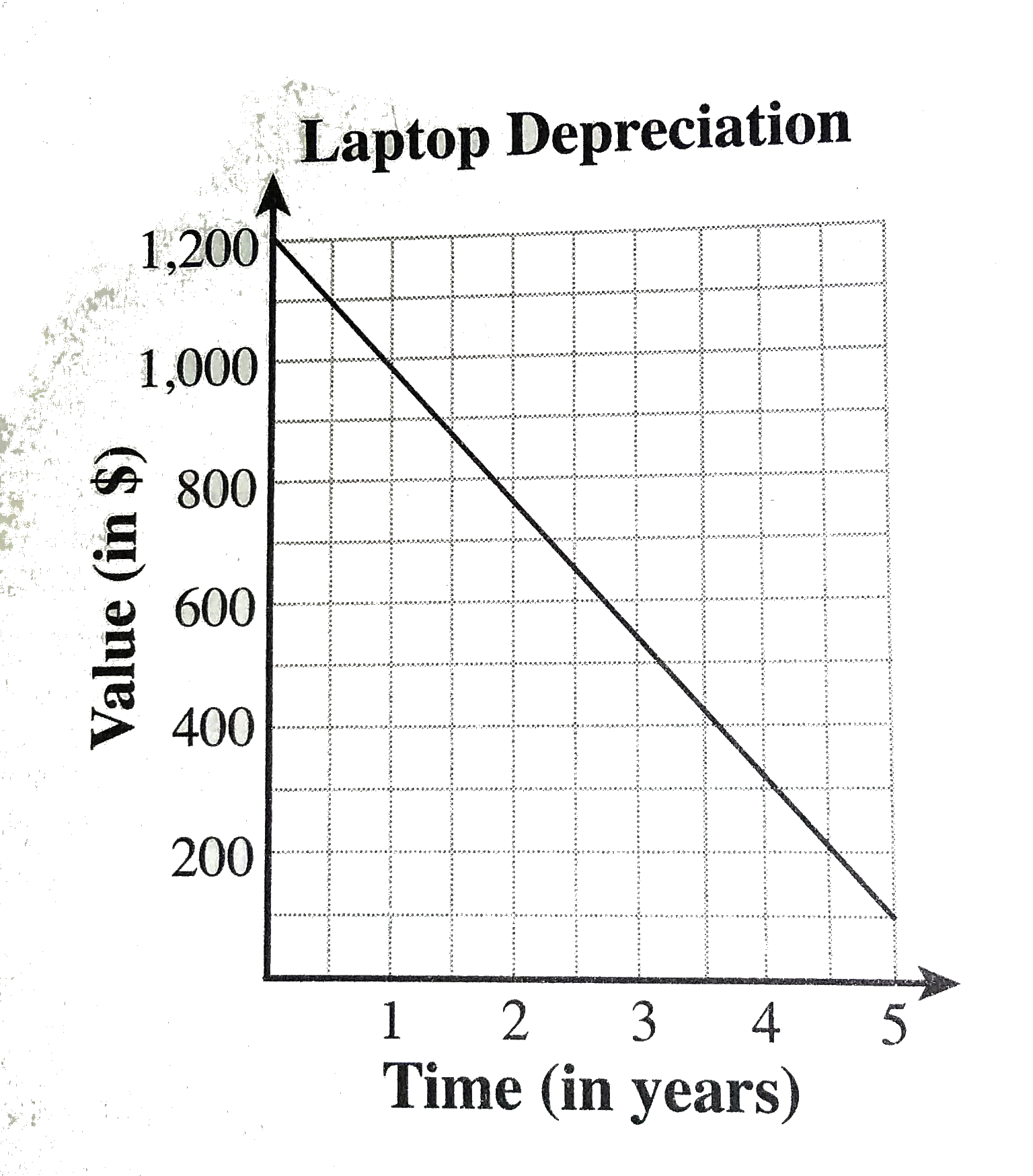

The figure above shows the straight-line depreciation of a laptop computer over the first five years of its use. According to the figure, what is the average rate of change in dollars

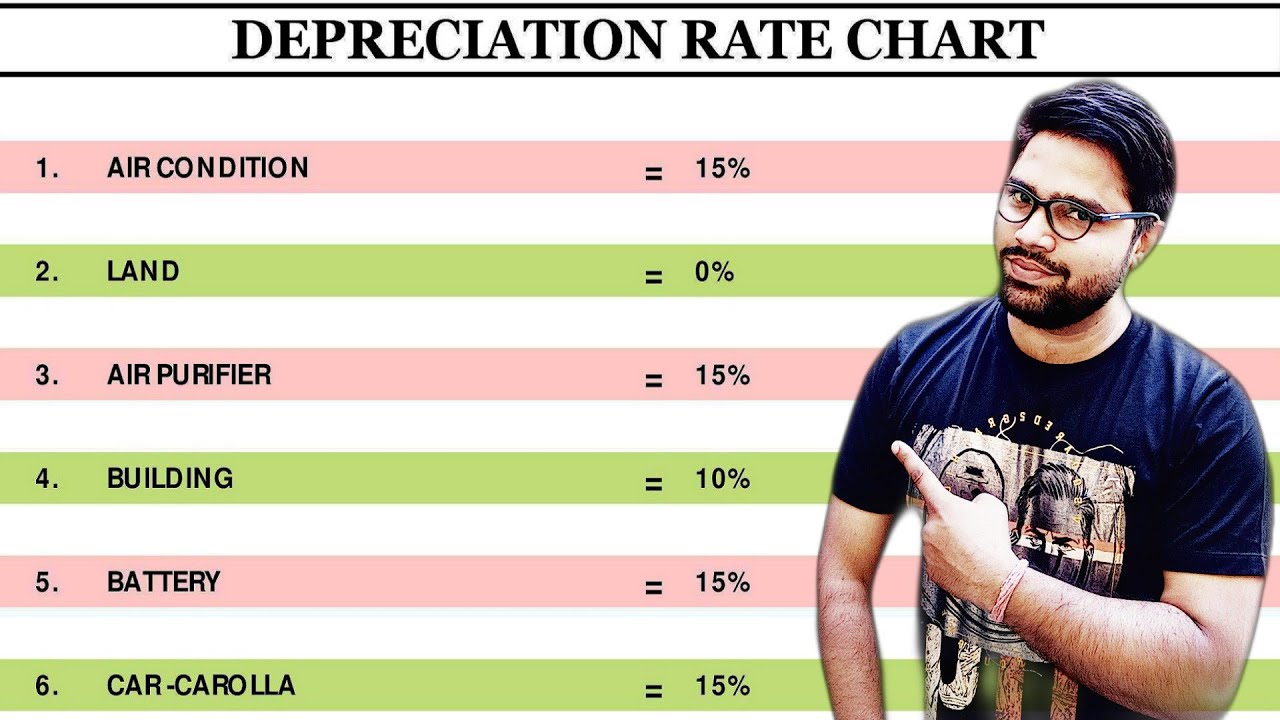

Depreciation Rate As per Income Tax Rules | Depreciation Rate Chart | Dep Rate Chart | Depreciation - YouTube